A company is a legal entity formed by a group of individuals to engage in and operate a business—commercial or industrial—enterprise. In India, companies are primarily governed by the Companies Act, 2013, which defines the rules, rights, and responsibilities of businesses operating as companies. This article explores the fundamentals of what defines a company, the types of companies in India, distinctions like public vs. private, and more..

1.Definition of a Company (As per Indian Law)

According to Section 2(20) of the Companies Act, 2013, a company is defined as:

“a company incorporated under this Act or under any previous company law.”

This means any organization that has been legally registered (incorporated) under the Companies Act, 2013, or any earlier legislation like the Companies Act, 1956, is considered a company.

A key characteristic of a company is that it is a separate legal entity. This means:

- The company exists independently from its owners (called shareholders) and the people who manage it (called directors).

- It can own property, enter into contracts, sue or be sued in its own name.

- The liability of shareholders is usually limited to the amount unpaid on their shares.

Example:

Suppose ABC Pvt. Ltd. is a company incorporated under the Companies Act.

It owns an office building and has taken a loan from a bank.

If ABC Pvt. Ltd. fails to repay the loan, the bank can sue the company, but not the individual shareholders or directors, unless they have given a personal guarantee.

If a shareholder of ABC Pvt. Ltd. dies, the company continues to exist — because it has a separate legal identity.

This concept ensures business continuity and protects personal assets of shareholders.

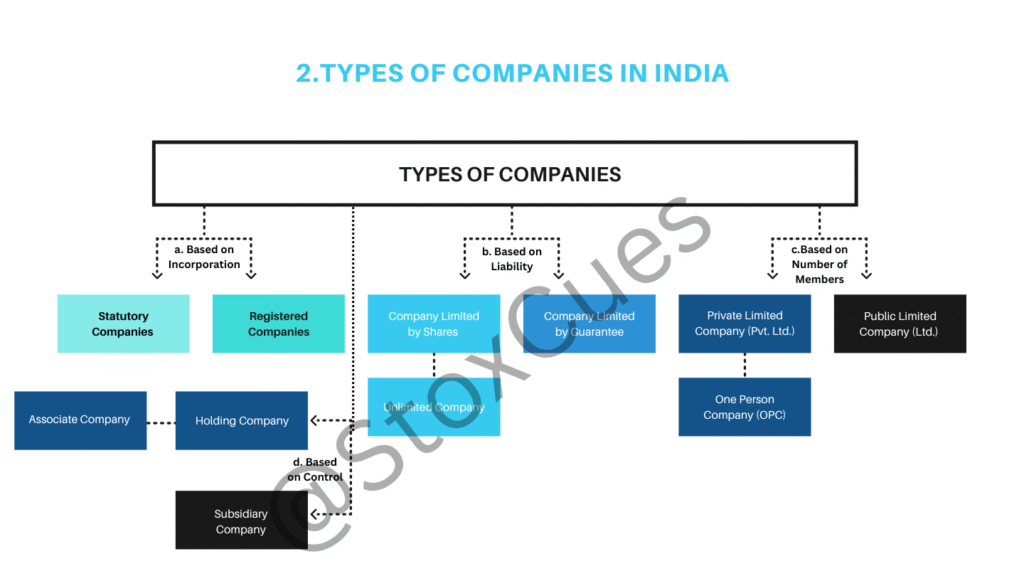

2.Types of Companies in India

Under Indian law, companies can be classified based on how they are formed, the liability of members, number of members, and control structure.

a. Based on Incorporation

- Statutory Companies

- These are formed by a special Act of Parliament or State Legislature.

They have specific public functions and are governed by their respective Acts.- Example:

- RBI (Reserve Bank of India) – Formed under the RBI Act, 1934

LIC (Life Insurance Corporation of India) – Formed under the LIC Act, 1956

- RBI (Reserve Bank of India) – Formed under the RBI Act, 1934

- Example:

- These are formed by a special Act of Parliament or State Legislature.

- Registered Companies

- Formed under the Companies Act, 2013 or earlier versions.

Majority of businesses in India fall under this category.- Example:

- Infosys Ltd. – A public company registered under the Companies Act

- Example:

- Formed under the Companies Act, 2013 or earlier versions.

b. Based on Liability

- Company Limited by Shares

- Liability of members is limited to the unpaid amount on their shares.

Most common form of business entity.- Example:

- Tata Motors Ltd. – Shareholders are liable only for unpaid share capital.

- Example:

- Liability of members is limited to the unpaid amount on their shares.

- Company Limited by Guarantee

- Members’ liability is limited to the amount they agree to contribute in case of winding up.

Often used for non-profit organizations.- Example:

- NGOs or charitable foundations registered under Section 8 of the Companies Act.

- Example:

- Members’ liability is limited to the amount they agree to contribute in case of winding up.

- Unlimited Company

- No limit on members’ liability. Personal assets can be used to meet company debts.

Rare in India due to high risk.- Example:

- A consulting firm registered as an unlimited company (hypothetical, as actual names are rare).

- Example:

- No limit on members’ liability. Personal assets can be used to meet company debts.

c. Based on Number of Members

- Private Limited Company (Pvt. Ltd.)

- Minimum 2 and maximum 200 members.

- Cannot invite the public to subscribe to shares.

- Example: Flipkart Pvt. Ltd.

- Public Limited Company (Ltd.)

- Minimum 7 members, no upper limit.

- Can raise capital from the public via shares.

- Example: Reliance Industries Ltd.

- One Person Company (OPC)

- Only one member. Designed for solo entrepreneurs.

- Example: ABC Technologies OPC Pvt. Ltd. – Owned and managed by a single individual.

d. Based on Control

- Holding Company

- A company that controls another company (subsidiary) by owning majority shares.

- Example:

- Tata Sons Pvt. Ltd. is the holding company for several Tata Group businesses.

- Subsidiary Company

- A company controlled by another company (holding company).

- Example:

- Tata Consultancy Services (TCS) is a subsidiary of Tata Sons.

- Associate Company

- A company in which another company has significant influence, but not majority control (20% to less than 50% of shares).

- Example:

- If Company A owns 30% of Company B, B is an associate of A.

3.Private Company vs. Public Company

| Feature | Private Company (Pvt. Ltd.) | Public Company (Ltd.) |

|---|---|---|

| Minimum Members | 2 | 7 |

| Maximum Members | 200 | No limit |

| Shares | Not freely transferable | Freely transferable |

| IPO | Cannot issue to public | Can issue via stock exchange |

| Use of Name | Must include “Private Limited” | Must include “Limited” |

4.Company vs. Corporation

While “company” and “corporation” are often used interchangeably in casual conversation, they have subtle differences, especially under Indian law:

Company

- A company is a legal entity registered under the Companies Act, 2013 (or previous versions).

- It may be private, public, or one-person, and can be small, medium, or large in scale.

- Governed by the Ministry of Corporate Affairs (MCA).

Example:

- Infosys Ltd., Reliance Industries Ltd., Flipkart Pvt. Ltd. – All are companies registered under the Companies Act.

Corporation

- In India, the term “corporation” is not strictly defined in the Companies Act.

- It is usually used in two senses:

- Statutory Corporations: Entities formed by a special Act of Parliament or State Legislature for public services.

- Example:

- Indian Railways – Formed under the Ministry of Railways.

- Life Insurance Corporation (LIC) – Formed under the LIC Act, 1956.

- Example:

- Large Business Entities: Sometimes, large Indian or multinational companies are informally referred to as “corporations” due to their size or global presence.

- Example:

- Tata Group, Amazon, Microsoft – Though these are technically companies, they’re often called corporations due to their scale and operations.

- Example:

- Statutory Corporations: Entities formed by a special Act of Parliament or State Legislature for public services.

Key Difference:

| Feature | Company | Corporation |

|---|---|---|

| Legal Definition | Defined in Companies Act | Not defined in Companies Act |

| Formation | Registered under Companies Act | Usually via a special Act or informal usage |

| Scale | Can be small or large | Typically large or public-sector in context |

| Examples | Infosys, Flipkart, TCS | Indian Railways, LIC, Microsoft (informally) |

5.What Is a Holding Company?

As per Section 2(46) of the Companies Act, 2013, a Holding Company is a company that has control over one or more subsidiary companies, either by owning more than 50% of the share capital or controlling the composition of the board of directors.

Example: Tata Sons is the holding company for various Tata Group companies like Tata Motors, TCS, etc.

6. Key Features of a Company

- Separate Legal Entity: A company is distinct from its shareholders.

- Limited Liability: Liability of shareholders is limited to their shareholding.

- Perpetual Succession: The company continues even if shareholders or directors change.

- Transferability of Shares: Easier in public companies, restricted in private companies.

- Common Seal (Optional): Acts as the official signature (not mandatory post-Companies Amendment Act, 2015).

- Artificial Legal Person: Can own property, sue and be sued.

7. How to Register a Company in India

Steps to register a company under the Ministry of Corporate Affairs (MCA):

- Obtain Digital Signature Certificate (DSC)

- Get Director Identification Number (DIN)

- Reserve Company Name (via RUN or SPICe+ Part A)

- File Incorporation Form (SPICe+ Part B)

- Obtain PAN, TAN, and GST (if required)

- Receive Certificate of Incorporation

The registration process can take 7–15 working days if all documents are in order.

mi45ve