Overview of Bharat Gears LTD

Serving mainly the automotive and industrial industries, Bharat Gears Ltd (BGL) is among the top producers of automotive gears and components in India. Originally founded in 1971, it has developed a solid name for manufacturing premium gears for passenger and commercial vehicles as well as for other engineering uses.

Among the company’s goods are gears, axles, shafts, and other vital automobile parts. Two- wheelers, passenger cars, and big commercial vehicles among other vehicle kinds depend on these parts for their operation. Bharat Gears exports their goods to other nations, therefore establishing a strong presence in the worldwide market.

Corporate Profile and Important Activities

Industry and Products

Operating with a strong manufacturing facility in Mumbai, India, Bharat Gears Ltd uses modern technologies for its production lines. Serving main original equipment manufacturers (OEMs) in the automobile sector, the company is well-known for its precision engineering in gear fabrication.

Important items:

Automotive gears:

precision gears applied in car transmissions systems.

Various Gears:

Important elements in driving systems.

Shafts and axles:

Fundamental for vehicle performance and mobility.

Tailored Gear Solutions:

tailored to particular industrial needs.

Maintaining strict quality control criteria and using Lean Manufacturing to reduce waste and enhance manufacturing efficiency is something the company takes great satisfaction in.

Industry Representation and Customers

Among the many top-tier OEMs Bharat Gears Ltd. serves—Maruti Suzuki, Tata Motors, Ashok Leyland, and others—are several It also benefits businesses in the industrial sector by providing goods essential to machinery in areas such manufacturing, mining, and building.

Bharat Gears Ltd. Financial Situation

Profitability and Income

Driven by more demand for automotive parts, especially in the Indian market, Bharat Gears Ltd. has showed a somewhat consistent growth path throughout the years. It has also profited from good export prospects, especially with worldwide manufacturers seeking reasonably priced, premium car parts.

Though like many manufacturing enterprises, recent financial statements show a strong performance; yet, global economic conditions, raw material costs, and shifting demand in the automobile industry cause swings in this performance.

Revenue:

With occasional upticks during times of market expansion, Bharat Gears Ltd. has usually seen steady revenue increase year-on-year.

Profits Margins:

Global raw material prices, the value of the Indian rupee, and client demand variations often affect profit margins. Though margins are under pressure because of growing manufacturing input prices, the company has kept a good margin.

Bharat Gears Ltd.’s Stock Performance

historical stock trends

Typical for the automotive and manufacturing industries, which are highly vulnerable to changes in demand, supply chains, and macroeconomic situations, Bharat Gears Ltd’s stock price has displayed considerable volatility. The company’s stock has shown consistent increase over years, although not without swings linked to market corrections, world crises, and the regular slow down in the automotive sector.

Historical Stock Prices:

2019–2021: As the automotive sector recovered from the 2018–2019 slump, BGL’s shares showed a somewhat steady upward path. Furthermore supporting stock success were the export earnings of the corporation.

The impact of the pandemic’s economic ripple effects—including supply chain disruptions and shortages of raw materials—cause Bharat Gears to have some stock swings in 2022–2023. A general slowing down in the global automotive industry has put strain on the stock.

Recent Stock Activity (2024–2025)

Bharat Gears Ltd’s stock price has undergone interesting swings as of 2024. Although the company’s foundations are still robust, outside variables including the worldwide semiconductor scarcity, inflation, and supply chain interruptions have added to the volatility. The company’s strong operational record and strategy emphasis on boosting exports and diversifying its client base have, nonetheless, cautiously hopeful investor attitude.

Highlights of stocks:

Variations in cost:

Early 2024 has seen some increasing activity in the stock, particularly as new Indian manufacturing lines have begun and automotive demand has recovered.

Market mood:

The automobile industry has seen a minor comeback; given significant infrastructure developments in India, the company’s future seems bright.

Factors Affecting Stock Performance of Bharat Gears Limited

dynamics in the automotive sector

Bharat Gears Ltd’s stock performance is intimately related to the state of the automobile industry. Any slowdown in vehicle sales or delays in vehicle manufacturing directly influences the market for automotive components, therefore influencing the company’s income sources and, hence, its stock price. Conversely, times of fast automotive expansion—such as those surrounding the introduction of new cars or expansions in the manufacturing of electric vehicles—can help the business function better.

Costs of Raw Materials

Like other producers, Bharat Gears deals with swings in the cost of raw materials including steel, aluminum, and other alloys. Any increase in the cost of commodities directly influences the margins of the business, so influencing investor confidence and stock prices.

Issues in Global Supply Chains

Bharat Gears exports a good amount of its goods all over. Global supply chain problems include delays in component availability or shipment interruptions can so affect financial performance and impede manufacturing plans.

State of the Domestic Market

The company’s growth is much influenced by India’s fast expanding automotive sector. Government initiatives supporting the automobile industry, such subsidies for electric cars (EVs) or local production, might increase demand for Bharat Gears’ goods, hence driving up stock prices.

Bharat Gears Ltd Stock Risks

Being a manufacturing and automotive component company, BGL is more likely to experience market volatility—especially with regard to changes in raw material pricing and automotive demand.

Bharat Gears competes fiercely from both local and foreign players. Its market share could change depending on any change in the dynamics of the market or competitor technical development.

Changes in government policies, such tougher environmental standards or negative trade policies, could negatively affect the operations and stock performance of the company.

Conclusion

Having a long history of offering premium gear and axle goods, Bharat Gears Ltd is a strong participant in the Indian automotive and industrial component manufacture scene. The business has showed tenacity and adaptation in spite of obstacles including worldwide economic upheavals, changes in raw material prices, and competition.

Supported by a resurgent automotive industry and continuous strategic attempts to increase its export markets, Bharat Gears shows promise as of 2024. Macroeconomic events could cause short-term fluctuations in the performance of the stock; yet, the company’s strong operating basis and long-term prospects make it an appealing choice for investors.

Financial Ratios of Bharat Gears Ltd

Essential instruments for evaluating the situation of a company are financial ratios. They enable investors to better grasp a company’s resource management, profitability generation, and industry-wide rival comparison performance. Let’s examine some of the most important financial ratios for Bharat Gears Ltd.

Ratios on Profitability

These ratios provide information about Bharat Gears Ltd.’s profitability generation efficiency with regard to resource use.

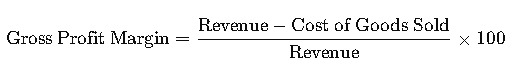

Margin of Gross Profit:

One good gauge of a company’s manufacturing efficiency is its gross profit margin. The computation is:

Usually above average in the auto component sector, Bharat Gears’ gross profit margin has been driven mostly by changes in raw material prices and world economic situation.

Margin of Operations Profit:

Operating profit margin shows the percentage of income remaining after deducting variable manufacturing costs including wages and raw materials, so revealing the operational efficiency of the business.

Traditionally, Bharat Gears has kept a respectable operating profit margin—often within the region of 10–15%. For a manufacturing company, where the nature of the industry causes significant running expenses, this is really good.

Margine of Net Profit:

This ratio reveals the proportion of every dollar of sales turned into profit. Bharat Gears’s net profit margin has fluctuated over the past few years, mostly in line with economic conditions; yet, it has generally stayed above 5-7%, which demonstrates good performance in a competitive market.

Ratios of Liquidity

With its short-term assets, liquidity ratios illustrate how readily a corporation can satisfy its short-term liabilities.

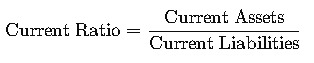

Right now: ratio

The computed current ratio is:

A current ratio more than one shows that the business can meet its immediate debt. Usually ranging from 1.5 to 2.0, this ratio indicates that Bharat Gears has enough short-term assets to cover its liabilities, therefore indicating financial soundness.

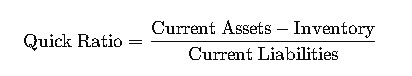

Short or Quick Ratio:

Eliminating inventories from current assets, the quick ratio provides a stricter test of liquidity. Calculated as:

Usually ranging from 1.2 to 1.5, Bharat Gears Ltd’s fast ratio shows that the business can still satisfy its short-term needs without depending on inventory sales, which is crucial in times of economic crisis or fluctuation.

Ratios on Efficiency

Efficiency ratios show Bharat Gears’ best use of its resources to produce income and profits.

Ratio of asset turnover:

This ratio gauges the company’s sales generating efficiency from its assets’ use. The equation is:

Typical for the automobile manufacturing industry, Bharat Gears has seen its asset turnover ratio swing about 0.6 to 0.8. This implies that even if the business makes good use of its assets, there could still be space for development in terms of optimizing their total asset base.

Inventory Turnover Ratio:

In a given period, the inventory turnover ratio illustrates how many times the business replaces its inventory against sales. Manufacturing businesses with high raw material and finished product inventories depend especially on this.

Generally indicating solid inventory control, Bharat Gears Ltd’s inventory turnover has been steady, between 4-6 times a year. Higher turnover indicates the business is effectively turning its inventory into sales.

Use leverage ratios.

Leverage ratios show the degree of debt a business is running across to support its activities.

Ratio of Debt to Equity:

Comparatively, the debt-to—equity ratio shows the company’s overall debt against the equity of the shareholders. Bharat Gears Ltd. has usually had a low ratio, which suggests that it runs minimum debt to support its activities. This is usually seen as a good indicator, particularly in the manufacturing industry where strong loan reliance occasionally backfires during recessionary times.

Often staying around 0.5, Bharat Gears’ debt-to—equity ratio indicates careful debt use and a strong equity base.

The interest coverage ratio is:

This ratio gauges the company’s debt-related capacity to pay interest. A larger ratio alludes to great capacity for debt service.

Generally speaking, Bharat Gears Ltd’s interest coverage ratio has been more than 5, indicating that the business is in a financially strong state and has no issue paying interest.

Recent Stock Performance (2024–2025)

Movement of Stock Prices

Over the past few years, Bharat Gears Ltd.’s stock has moved erratically. Following a low point during the epidemic in 2020, the stock exhibited indications of recovery in 2021 and 2022 but remained prone to swings, particularly in view of the worldwide supply chain crisis of 2022.

Supported by a comeback in the automobile industry, the stock displayed a minor increase in 2024. Particularly considering the company’s solid market position, good order book, and export increase, investors were cautiously hopeful.

But as of mid-2024, the stock saw some drop mostly from rising raw material prices and worries about the growth pace of the automobile industry. At the time, the stock price was hovering between ₹450–₹500 per share, a 20–25% rise from the lows the epidemic caused.

Elements Affecting stock performance

Many elements affect the stock performance of Bharat Gears Ltd:

Demand in the automotive sector:

For Bharat Gears, a rise in demand for automobiles—especially electric vehicles (EVs)—can be a main engine of development. As investors expect higher gear component purchases, this demand could raise stock prices.

Costs of Raw Materials:

Rising aluminum, copper, and steel prices could pressure margins and lower stock price performance. Likewise, a drop in these expenses can result in a positive stock performance and margin growth.

Domestic Policy and Export Demand:

Government initiatives meant to support manufacturing and exports as well as trade agreements could help Bharat Gears perform better, therefore affecting stock prices.

Analyzes’ Perspective

Although experts see Bharat Gears Ltd. cautiously optimistically, they stress the significance of keeping an eye on raw material prices and the state of the world automobile market. Given its solid operational record and growing worldwide demand for auto components, some experts predict the company’s stock will climb gradually over the next year.

Important Risks for Investors

Sensitivity of Economics

Bharat Gears is quite subject to more general economic conditions, much as many manufacturing businesses are. Its stock price and profitability could suffer from global recession, slowdowns in the automobile business, or geopolitical concerns including trade tariffs.

Price volatility of raw materials

Raw material prices—that of steel, aluminum, copper—can vary greatly, therefore influencing profit margins. An unexpected increase in raw material expenses could strain Bharat Gears’ profits, which would affect stock prices in turn.

Competitive Situation Landscape

Bharat Gears must contend with competition from both domestic companies and foreign manufacturers since the auto component market is quite competitive. Any change in market dynamics or competitor new technology development could influence the market share and stock performance of the company.

Conclusion

With high profitability, good financial ratios, and a clean operating record, Bharat Gears Ltd. is a tenacious participant in India’s automotive and manufacturing industries. Though outside events have caused swings in the stock over the years, it still has promise especially as demand in the automobile industry grows up. Still, the company’s future stock performance will rely on its ability to negotiate macroeconomic instability, competition, and raw material costs.

Revenue Breakout of Bharat Gears Ltd.

Division of Income

Two primary divisions of Bharat Gears Ltd. bring most of their income: industrial and automotive gears. Let us dissect this still more:

Automotive Gears

Share of Income:

About 70–75% of Bharat Gears’ overall sales originate from its automobile gear division. For both passenger and commercial vehicles, the company provides OEMs ( Original Equipment Manufacturers) a wide spectrum of gears.

Principal Consumers:

Among the most well-known names in the Indian automotive industry—Maruti Suzuki, Tata Motors, Mahindra & Mahindra, and Ashok Leyland— Bharat Gears boasts a varied clientele. Additionally exporting some of its car gears, the corporation helps to generate income.

Income Trends:

Thanks mostly to changes in the auto industry cycle and vehicle manufacturing schedules, the income from automobile gears has been somewhat erratic in recent years. Still, the company’s constant emphasis on broadening its clientele and implementing cutting-edge gear technology has kept a reliable income source from this division.

Industrial Gear Systems

Share of Income:

Usually accounting for 25–30% of the company’s income is the sector on industrial gears. Bharat Gears provides parts for heavy machinery, mining, and building as well as other sectors. The performance and lifetime of equipment depend on the gears applied in different sectors.

Trends in Income:

Although the industrial gear segment is less than that of automotive gears, it offers notable revenue stability particularly in times of reduced automotive demand. Targeting sectors needing customized gear solutions, Bharat Gears has been working on growing this market.

Geographic Income Distribution

Bharat Gears Ltd runs both here at home and abroad. Its income comes from many geographical areas, which helps to reduce the dangers connected to depending just on one market.

Domestic Market:

About 60–65% of the company’s income origin from the Indian market. Key engines for India’s prosperity have been its strong automotive industry and expanding infrastructural projects.

International Market:

Exports bring in the remaining 35 to 40 percent of income. Bharat Gears markets to nations including the United States, Germany, Italy, and other European nations. Bharat Gears is positioned to more aggressively enter these markets given the growing demand for quality automobile parts worldwide, particularly as nations keep spending in infrastructure and automotive manufacturing.

Bharat Gears Ltd.’s Growth Plans

Emphasize invention and technology.

Bharat Gears Ltd. gives constant innovation and technological developments great weight. The company has made investments in updating its manufacturing techniques using robotics, CNC (Computer Numerical Control) machinery, and automated quality control systems. These technical improvements enable Bharat Gears to:

Enhance Effectiveness:

Automation raises general productivity, lowers human mistake, and improves accuracy.

Improve the quality of products:

Modern technologies guarantees that the goods satisfy world standards, thereby enabling Bharat Gears to keep a competitive edge in the worldwide market.

Savings:

Modern production methods and automation help to lower waste and increase operational efficiency, therefore reducing costs.

R&D (research and development) has also been a top priority for the corporation in order to create fresh gear types including those used in electric cars (EVs.). Bharat Gears is preparing itself to get a share of the market by creating specialized gears that fit EVs as these vehicles become more popular all around.

Growing Export Markets

Bharat Gears has great export promise, as was already noted. To increase its presence, the firm has been aggressively investigating fresh foreign markets. Bharat Gears wants to lower reliance on the home market, which can be prone to cyclical slowdowns, by concentrating on growing its customer base in Europe and North America.

Bharat Gears has been striving on to increase exports:

Building rapport with OEMs:

Providing tailored solutions to fit particular demands, the company aims to establish long-term ties with foreign OEMs.

Establishing Strategic Cooperation:

To increase its footprint in overseas markets, Bharat Gears is seeking possible joint ventures or alliances with multinational companies.

varying Product Portfolio

To lower the risks connected with being mostly dependent on the automobile industry, Bharat Gears is continuously focusing on broadening its product offers. For instance:

Gears for electric vehicles (EV):

Bharat Gears has seen electric vehicles as a future development potential growing possibility. Starting the development of gears and transmission components especially for EVs, the company needs specialist components for their quieter and more energy-efficient running.

New Sector Industrial Gears:

Bharat Gears is also broadening its industrial gear line to include more upscale uses such robotics, automated systems, and renewable energy sectors. This will supply a more varied income stream.

Strategic acquisitions

Bharat Gears has been looking at strategic acquisitions in the auto components sector in order to forward its expansion objectives. This covers purchasing smaller businesses with presence in unexplored areas or offering complementing technologies.

Bharat Gears can rapidly adjust to changes in industry needs and enhance its product offers by acquiring companies with specific knowledge in new technologies.

Management and Leadership of Bharat Gears Limited

Advanced Team for Leadership

Leading Bharat Gears is a very seasoned management team with great production and engineering knowledge. Renowned for their practical approach, the leadership emphasizes operational excellence and ongoing development.

Director in Management:

Bharat Gears has been much guided through times of expansion and economic downturn by the present managing director (MD) of the company. The business has upgraded its supply chain management and embraced more technologically driven ideas under his direction.

Head R&D:

Emphasizing specialist markets like electric car components and extremely efficient industrial gears, the R&D leader of the company has driven inventions in product development.

Driving Bharat Gears towards its expansion goals, the leadership team is dedicated to make important decisions that will enable the business to seize new prospects in the industrial and automotive industries.

Business Transparency and Governance

Strong corporate governance policies are followed by Bharat Gears Ltd., which also reports operations and financial performance in open manner. The business guarantees that investors among other stakeholders have access to current operational and financial data.

Frequent Financial Declarations:

Quarterly and annual earnings reports allow the company to routinely inform its stakeholders on a thorough analysis of its revenue, profit, and outlook.

Sustainability Projects:

Emphasizing energy-efficient manufacturing techniques and thereby lowering its environmental impact, Bharat Gears has also been making progress in sustainability. This covers changing manufacturing water use to reflect renewable energy sources.

Future Risks and Challenges for Bharat Gears Limited

Raw Material Price Variablity

The volatility of raw materials like steel, aluminum, and copper is one of Bharat Gears’ main obstacles. Any notable price increase in these commodities can compromise the company’s profitability and margins.

Bharat Gears has looked at long-term contracts with suppliers and taken steps to increase operational efficiency in order to lower this risk; raw material price swings still cause issues.

Economic Slownews and Automotive Demand

The performance of Bharat Gears Ltd. is much correlated with the state of the world automobile industry. Any slowing down in vehicle production could affect demand for its goods, especially in India’s home market.

Economic slowdowns and geopolitical concerns can also cause supply chains to be disrupted, manufacturing costs to rise, and consumer expenditure to drop, therefore compromising Bharat Gears’ revenues.

Global Player Competition

Bharat Gears must contend with more competition from worldwide companies who might have access to better technologies and economies of scale if it grows into other areas. Maintaining a competitive edge will call both ongoing R&D investments and improved production process efficiency.

Conclusion

Supported by a dedicated operational excellence commitment, creative technology, and a strong leadership team, Bharat Gears Ltd. has developed a strong basis throughout the years. While diversifying its product line, the company’s growth plans center on increasing its market share in both home and foreign markets. Key obstacles relating to raw material price instability, competitiveness, and changes in the automotive sector, however, confront it.

Notwithstanding these obstacles, Bharat Gears is positioned to keep following its expansion path in the automotive and industrial industries with correct strategic execution. Particularly in the realm of electric vehicles, investors should monitor how the business responds to new technology developments and handles outside market risk.

Effects on Bharat Gears Ltd. of Electric Vehicle (EV) Trends

Change to EV Component Orientation

For Bharat Gears Ltd., the emergence of electric vehicles (EVs) offers a noteworthy potential. Demand for conventional internal combustion engines (ICE) is predicted to drop as the worldwide automotive sector moves toward greener, more energy-efficient technologies; demand for EV components—especially for electric drivetrains and gear systems—will climb. Bharat Gears may thus take advantage of the evolving scene of the market.

Emphasize EV Gear Systems.

Unlike conventional internal combustion engine (ICE) cars, electric vehicles call for a separate set of gear systems and transmissions. Though single-speed transmissions are common in EVs, specialized gears that guarantee energy efficiency, low noise, and improved torque management are still much needed.

Strong R&D background allows Bharat Gears to be positioned to create specific gear systems meeting this changing need. For electric drivetrains, for instance, planetary gear systems and torque distribution gears are crucial; Bharat Gears may use its manufacturing capacity to design and manufacture these parts.

Novel Business Prospectives inside EV Supply Chains

Collaboration with electric vehicle manufacturers:

Bharat Gears has the possibility to create fresh alliances with electric vehicle makers, both in India and abroad as more EV producers join the market. The business might present itself as a consistent source of specialist gear components to help the electric vehicle supply chain expand.

Electric Vehicle Ecosystem:

Bharat Gears can also examine the expanding infrastructure for charging stations. Although EV drivetrains mostly rely on gears, there is a chance to source parts for EV charging stations or battery packs where exact components are required.

EV Research and Development:

Creation of EV-Specific Goods:

Bharat Gears’s approach of entering the EV industry depends on R&D, so it is absolutely vital. The corporation is probably going to create fresh product lines especially for the needs of producers of electric cars. It might examine, for instance, manufacturing lighter, more durable materials or gears maximizing energy efficiency in electric vehicles.

Affordable fixes:

The great expense of manufacturing presents a major obstacle for EV makers, especially with regard to the driveline and drivetrain systems. Bharat Gears may concentrate on supplying OEMs in the EV sector reasonably priced solutions, therefore enhancing their competitive edge as they grow production.

Possible Difficulties

Even although the EV sector has great promise, Bharat Gears has to overcome some obstacles:

Technology adaptation:

Unlike its conventional vehicle components, EV technology involves constant innovation and adaptation of manufacturing techniques, which the firm will have to do.

EV-Specific Suppliers’ Competition:

Many businesses focus in EV parts. Bharat Gears could have trouble gaining market share if more recent competitors, solely focused on electric car technologies, challenge it.

Effect of Global EV Trends on Bharat Gears Ltd.

Global EV Demand Explosion

Development in Worldwide EV Sales:

Countries such China, Europe, and the United States leading the way in EV adoption have driven the global demand for electric vehicles—which has been explosive. Bharat Gears Ltd. can gain greatly from this expansion given its increasing worldwide market presence. Bharat Gears can land long-term agreements to provide vital gear systems for their vehicles as European and American manufacturers increase EV output.

Government policies and incentives:

To encourage EV acceptance, many governments all around the world are enacting laws, tax incentives, and subsidies. By providing solutions catered for EV producers wishing to take advantage of these incentives, Bharat Gears may leverage these advantageous rules. For instance, the FAME II (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) initiative could generate demand for reasonably priced yet premium EV components in India.

Turning now to sustainability and clean energy

Manufacturing’s sustainability:

Bharat Gears Ltd. is well-known for its dedication to streamlining production techniques. The company’s emphasis on energy-efficient production will probably help it fit with trends of global sustainability as the world shifts toward renewable energy. Environmentally minded investors and EV industry partners eager to collaborate with businesses dedicated to lowering their carbon footprints could find this appealing.

Electric vehicle recycling:

Demand for sustainable practices and battery recycling rises alongside the acceptance of electric vehicles. Bharat Gears could potentially look into fresh prospects in the recycling of automobile parts, making sure they satisfy environmental criteria.

Future Investment Plans of Bharat Gears Limited

R&D and Technological Improvements: Investments

Research and development investment by Bharat Gears is one of the main foundations of its future expansion. Bharat Gears is emphasizing on to keep ahead of the curve in the very competitive automotive and industrial gear manufacturing sectors:

EV-specific R&D funding

The company is supposed to increase R&D spending especially for components related to electric cars. Investing in gear systems tailored for electric drivetrains—which demand different criteria than conventional ICE vehicles—is part of this also.

Bharat Gears may also look at working with colleges and research labs to keep on top of developing trends in renewable energy-related components, battery systems, and electric mobility.

Automaton and Smart Manufacturing

Although Bharat Gears has already started down the road toward automation in its manufacturing lines, more investment in smart manufacturing systems, AI-driven quality control, and IoT (Internet of Things) integration will be very vital. These technologies will increase operational efficiency, lower manufacturing costs, and let the business create faster higher-quality components.

Industry 4.0: Bharat Gears can maintain high-quality standards and boost output by adopting Industry 4.0 ideas, which will be very important as the market for complex gear systems rises in both conventional and electric cars.

Global Footprint Expansion

Given its expansion plan, Bharat Gears is probably going to keep increasing its global profile. This will need:

Growing in Developing Markets

Bharat Gears can look at boosting its activities in developing nations like Southeast Asia, Africa, and areas of Latin America where the automotive sector is rising quickly. Vehicle demand is rising in these areas, hence Bharat Gears could find long-term contracts to provide parts for nearby producers.

calculated purchases

Particularly those with knowledge of electric car parts, the corporation can think about buying smaller participants in the automotive component market. Along with increasing Bharat Gears’ technological capacity, acquisitions would give access to new markets and consumer bases.

Cooperation & Partnerships: Joint Ventures

Bharat Gears might look at joint ventures with multinational EV manufacturers or technology businesses to hasten its arrival into foreign markets. These partnerships might enable Bharat Gears to establish a strong presence in important EV markets and hasten its expansion in this highly promising industry.

Ecological Investment and Sustainable Manufacturing

Bharat Gears is probably going to make investments in more ecologically friendly manufacturing techniques as part of their sustainability dedication. This consists of:

Green Technology for Manufacturing

For its manufacturing sites, Bharat Gears most certainly will make investments in sustainable energy sources and energy-efficient technologies. Other renewable energy sources include solar panels and wind power could help the business to lower its carbon footprint and match it with world sustainability objectives.

Circular Economy and Waste Management

With an eye toward lowering waste in the manufacturing process and boosting recycling, the company should look at refining its waste management systems. Investing in a circular economy could also enable Bharat Gears to cut environmental damage and more effectively use resources.

Conclusion

Bharat Gears LTD. has a great chance to change its business strategy and profit from the growing acceptance of electric vehicles (EVs) given this developing trend. Bharat Gears is positioned to create the specific gears and components needed for electric drivetrains given its great R&D capacity. Bharat Gears is also probably going to spend more in automation, R&D, and international development as the global EV industry grows in order to keep its competitive edge.

Bharat Gears has bright future prospects particularly since it fits global sustainability trends and the trend toward greener energy. The corporation will still have to negotiate difficulties with regard to technological adaption and fierce competition in the EV market, though Bharat Gears can guarantee long-term development and success in the changing automotive and industrial scene by choosing the correct investments and welcoming technology breakthroughs.

Bharat Gears LTD’s financial performance

Profit and Revenue Growth

Particularly in the automotive sector, Bharat Gears Ltd. has exhibited a rather consistent revenue trajectory; yet, market conditions, raw material price volatility, and the cyclical character of the automotive sector have caused changes in its profitability.

Year on Year Increase

With automotive gears holding the biggest proportion, the company has been showing modest year-on-year increase in revenue. But as factories closed and supply chains were disrupted during the COVID-19 epidemic, Bharat Gears—like many companies in the manufacturing sector—saw notable disturbance in its operations.

But Bharat Gears noticed a comeback in demand as world car manufacture started to improve, particularly in the later half of 2021 and 2022. The company’s capacity to overcome obstacles and recover points to its resilience against outside events.

Profitability

Recent years have seen some margin erosion for Bharat Gears mostly related to raw material pricing and overheads. The business has, nevertheless, effectively addressed these difficulties by means of cost-cutting programs and factory automation enhancement.

Profitability-wise:

Though raw material prices vary, Bharat Gears has a rather constant OPM.

Net Profit: Driven by both domestic market conditions and worldwide demand, the company’s net profit has varied. Maintaining profitability has mostly been attributed to the export market, particularly in view of global demand for industrial gears and automotive components.

Strength of a Balance Shepherding

With quite modest debt levels compared to industry colleagues, the company has a healthy balance sheet. This helps Bharat Gears to better absorb shocks, so allowing it to invest in R&D, increase its operations, and investigate acquisitions free from excessive leveraging.

Important Financial Indices to Track

The main financial indicators investors should monitor to evaluate Bharat Gears Ltd’s performance are:

Earnings Per Share, or EPS

One very important measure of Bharat Gears’ profitability is their Earnings Per Share (EPS). Usually, a rise in EPS indicates that the business is doing reasonably in terms of cost control and income development.

Equity’s Return on Investment (ROE)

For investors, Bharat Gears’ Return on Equity (ROE) is a crucial indicator of how successfully it makes use of the equity of its owners to turn a profit. A high ROE points to good capital allocation and financial stability.

P/E, or price-to—earnings ratio:

P/E ratio of Bharat Gears offers understanding of how the market regards its profits. While a greater P/E ratio would signal that the company is overpriced, a lower P/E ratio than industry peers could point to undervaluation of the stock.

Ratio of Debt-to– Equity

With a reasonable debt-to-equity ratio, Bharat Gears shows that it is not too dependent on debt to support expansion. This is crucial to guarantee that the business is financially steady even during worldwide disturbances or slowdowns in the economy.

Ratios for Profitability and Efficiency

Margin of Operation

Excluding non-operational costs including interest or taxes, the operating margin gauges Bharat Gears’ capacity to turn a profit from its main activities. This indicator is very important since it shows how effectively the daily operations of the organization reflect its efficiency.

Margin Gross:

The gross margin shows Bharat Gears’ profitable rate of production of its goods. Tracking gross margins is crucial for the company, which mostly depends on raw materials like steel, to make sure it can remain profitable among changing material prices.

Competitive Positioning of Bharat Gears Ltd. in the Sector

The Competitive Edge of Bharat Gears

Strong clientele

From OEMs (Original Equipment Manufacturers) in the automotive sector to sectors in construction and mining, Bharat Gears attracts a varied clientele. The company’s long-standing ties to top firms such Maruti Suzuki, Tata Motors, Mahindra & Mahindra, and Ashok Leyland have helped it to keep chosen provider of automotive gears in India.

Expertise in Technology

The company has a competitive advantage in manufacturing high-precision gears at scale since it has regularly spent in sophisticated technology and automation. Bharat Gears keeps ahead of rivals in terms of product quality and manufacturing efficiency by stressing Research and Development (R&D) and using Industry 4.0 techniques.

Export Marketplaces

Although Bharat Gears has always focused domestically, its entry into foreign markets has been successful, enabling the business to leverage worldwide automobile manufacturing capacity and industrial manufacturing needs. Expanding its export company helps Bharat Gears to lessen its cyclical dependency on the Indian market.

Creativity and Customization

Bharat Gears developed its name on offering tailored solutions for many sectors, especially in industrial ones. Especially in sectors like mining, building, and heavy machinery, this adaptability to fit particular needs is a major competitive advantage.

Industry Trends and Position of Bharat Gears

Trends in the Auto Sector

With a significant focus on electric cars (EVs), autonomous driving, and shared mobility, the worldwide automotive sector is seeing a radical makeovers. Bharat Gears has to be ready to change its offers to fit these trends. Bharat Gears has a special chance to innovate in the electric drivetrain components presented by the expanding EV trend.

Competition

In the gear manufacturing sector, Bharat Gears competes both domestically and internationally from players. More advanced technologies and economies of scale could be advantages for international producers. Bharat Gears can keep its edge, nevertheless, by emphasizing localization and offering first-rate customer service—qualities lacking from global rivals in India.

expanding infrastructure projects

India’s drive for infrastructure development—road building, railroads, smart cities—offers Bharat Gears a chance to meet the rising industrial gear demand. Bharat Gears could land more contracts in growing sectors like mining and construction, therefore diversifying its income sources as these sectors expand.

Investors’ Viewpoint: Evaluating Bharat Gears Ltd.’s Stock

Variability in stock price movements

Investors wishing to make Bharat Gears Ltd. investments should be advised of the volatility of the stock. The stock has seen periodic swings over the past few years mostly related to industry performance and market conditions. Important markers to assess the long-term viability of the stock are the P/E ratio, EPS increase, and dividend yield.

Investment Short-Term vs. Long-Term

Bharat Gears’s stock could fluctuate for short-term investors depending on quarterly results, raw material pricing, and world automotive trends. Long-term investors, however, could find the company intriguing because of its strong market position and the expansion possibilities connected to the EV sector and infrastructure building in India.

Dividend Policies

For income-oriented investors, Bharat Gears has always been a reliable dividend producer, which appeals. But since the business spends extensively in R&D and growth, its future dividend pay-off could vary.

In essence, is Bharat Gears Ltd a wise investment?

Based on its robust market position, technological developments, and possibility for expansion in the electric car and industrial sectors, Bharat Gears Ltd has a good investing case. The company’s strong management, dedication to innovation, and export market diversification help to position it for the future.

Still, the hazards—from raw material price volatility to more global market competition—mean that investors have to be ready for any short-term swings. If Bharat Gears keeps emphasizing on its growth strategies—that is, EV component development, expansion into emerging countries, and raising of its market share in industrial gears—long-term investors may find value in the company.

Before deciding what to invest in, as always, investors should closely check management choices, industry trends, and financial performance.

Current Stock Performance and Bharat Gears Ltd.’s Trends

Review of Stock Prices

Typical of firms in the industrial and automotive sectors, Bharat Gears Ltd.’s stock has shown substantial volatility over the past few years. The company’s stock price has been on a general increasing trend as of 2023, although not without swings depending on market conditions, investor mood, and outside events such changes in government regulations and commodity prices.

After COVID-19 Recovery

Like many businesses, Bharat Gears witnessed a drop in stock price during the COVID-19 epidemic as car manufacturing stalled and worldwide supply networks were disrupted. Nonetheless, the company has recovered steadily because to rising demand for car gears, a return in the industrial machinery sector, and the resumption of worldwide automobile manufacture.

New Rally for Stock

The company’s stock price clearly jumped in 2022 in line with India’s general economic recovery. This march was ascribed to:

- More demand than predicted in the automotive industry, particularly from domestic manufacturers.

- Growing hope about EV trends and Bharat Gears’ possible component supply for electric cars.

- Positive quarterly reporting and higher income growth.

Variability and investor sentiment

The stock of Bharat Gears has stayed erratic despite the increasing tendency. This results from:

- The automotive sector is cyclical.

- Changing raw material costs, notably steel and aluminum, which are vital for gear manufacture.

- The unknown nature of world supply networks, particularly the reliance on imported components and raw resources.

As triggers for future stock movements, investors should attentively check the quarterly results of the company and any updates on the development of EV components or expansion of the overseas market.

Examination of Important Stock Indices

P/E, or price-to— Earnings Ratio

Although Bharat Gears Ltd.’s P/E ratio has been rather constant, it varies with the state of the markets. The company’s P/E ratio is greater than the industry average as of the most recent updates, suggesting strong future expectations of growth by investors. Though in Bharat Gears’ case it indicates trust in the company’s future earnings potential, especially in the EV industry and export markets, a high P/E ratio can occasionally indicate that a stock is overpriced.

Yield of Dividends

Regular dividend payments to shareholders have helped Bharat Gears Ltd. to keep a strong dividend policy. For income investors, the company’s somewhat pleasing dividend yield makes it an interesting asset. The payout ratio could be rather erratic, though, as Bharat Gears seeks to commit R&D and development funds. Dividend reinvestment techniques may therefore be helpful for those looking to steadily compound gains.

Liquidity and Market Capitalisation

With a market capitalization that places Bharat Gears as a well-known participant in the automotive components and industrial gear manufacturing industry, the stock is regarded as a mid-cap. The company keeps good liquidity, which makes it reachable for institutional and retail investors. Usually solid indicators of substantial investor interest are the average trading volume and market depth.

Factors Affecting Stock Performance of Bharat Gears

cycles in the automotive sector

Bharat Gears’ performance directly relates on the expansion of the automotive sector. Global auto manufacture and vehicle sales influence demand for its gears and drivetrain systems among other parts. Macroeconomic elements should be of interest to investors; these include:

- Interest rates affect consumer car expenditure as they do general expenditures.

- Inflation influences consumer demand and manufacturing costs.

- Geopolitical conflicts that could influence raw material movement or supply networks

Prices for Raw Materials

The profitability of Bharat Gears is highly influenced by changing raw material prices, especially for steel and aluminum. Since these goods make a significant share of the manufacturing cost, any price increase resulting from supply chain problems or world demand would put pressure on margins from below.

Market Growth for Electric Vehicles

Bharat Gears mostly depends on the expanding demand for electric vehicles worldwide since the company wants to broaden its products for electric drivetrains. Investors should check:

- Government policies about the acceptance of electric vehicles (such as tax incentives or subsidies).

- Especially gear systems and drivetrain solutions, Bharat Gears’ capacity to meet the current technological needs in EVs reveals itself.

Global Advancement

Bharat Gears wants to be more visible in foreign and developing markets. Expanding into areas including sections of Europe, Africa, and Southeast Asia could generate fresh income sources. The company’s stock price will be much affected by its capacity to land long-term contracts in these areas, particularly from international producers of industrial machines or multinational automakers.

Investor Opinion and Market Prospective for Bharat Gears LTD

Positive Outlook resulting from infrastructure development and EV growth

Because of its emphasis on innovation, market expansion, and ability to fit global automotive trends, especially electric vehicles, Bharat Gears Ltd. is seen as a strong option for development in the next years. Generally, investor attitude on the firm is positive.

Positive Opinion on EV Development

Investors are hopeful Bharat Gears can supply vital components for EV drivetrays given the increase of electric transportation and the growing push for greener energy choices. Globally, especially in Europe and Asia, the growing demand for electric cars presents a significant chance for the corporation to grow its operations.

Infrastructure Advancement

For Bharat Gears, India’s infrastructure explosion—which includes smart cities, railroads, and road building—also offers chances for development. Particularly in the mining and building industries, the company’s emphasis on industrial gears helps it to profit from government infrastructure projects.

Considerations of Risks and Challenges

Although the future seems bright, Bharat Gears Limited runs various hazards that can compromise its performance:

Raw Materials Price Variations

Manufacturing at Bharat Gears revolves mostly on raw materials like steel and aluminium. Price increases in some materials could compromise profitability, particularly if the business cannot pass these expenses on to consumers.

Rivalry from international players

Bharat Gears must contend with fierce competition from both domestic and foreign companies as demand in EV components rises. Bigger worldwide businesses specializing in EV transmissions or electric drivetrain components could present a great challenge.

Technological Turns

Bharat Gears has to keep heavily investing in R&D to meet the changing needs of electric vehicles since the automotive sector is fast changing. Its market share may suffer if one fails to adjust to these developments or lags behind in technical innovation.

In essence, investment viewpoint on Bharat Gears Ltd

For long-term investors concentrated on the automotive components industry and industrial gear manufacture, Bharat Gears Ltd presents a solid investment prospect. The company is a major participant in the changing automotive ecosystem since it can innovate, increase the range of products it offers, and leverage the expanding electric vehicle industry.

Bharat Gears’s strong track record of development, strategic emphasis on R&D, and diversification into worldwide markets point to it being well-positioned for future success even if raw material price fluctuation, competition, and technical changes carry hazards.

If value investors keep an eye on important market factors including raw material pricing, EV adoption, and corporate R&D development, Bharat Gears’ quite consistent dividend yield and appealing P/E ratio may be a solid addition to a long-term investment portfolio.